What is cryptocurrency?

by Scott Dutfield · 04/03/2019

How do people make Bitcoin, and why is blockchain changing how we work online?

You’ve probably heard of Bitcoin. At the end of 2017, a boom in the market made a lot of people very rich. In a matter of weeks the value of a single Bitcoin shot up from around £2,300 to almost £15,000 ($3,000 to $19,300). Some people who already owned Bitcoins became millionaires. Others scraped together savings to try and make a quick profit. But what is a Bitcoin?

It certainly isn’t something you can hold or keep in your purse. You can’t use it in a supermarket, and nobody is minting physical Bitcoins. That’s because it’s a digital currency, and one that can be ‘mined’ by using computers to solve mathematical puzzles. It’s all possible thanks to a technology called blockchain, which is changing the way businesses and people around the world work. Bitcoin might be getting the headlines, but the cryptocurrency only exists thanks to blockchain. Let’s find out how it all works.

Building blocks

We’ll start with blockchain because it’s the basis upon which cryptocurrencies are built. There are all kinds of different uses for blockchain, and cryptocurrencies like Bitcoin are just one. A blockchain is basically a digital ledger. It lets people and businesses record transactions and track assets, and the records are all stored securely across multiple devices. An ‘asset’ could be anything from a car or a house to a patent or a copyrighted logo. The blockchain itself is shared between multiple users, and when a new transaction takes place it updates for everyone at the same time. Every transaction is logged and tracked across the whole network of connected users, so you can’t adjust anything later; the information is recorded for good.

But why is this useful? To understand, let’s look at blockchain being used in the context of buying a house. The process involves lots of people. It starts with the builder, who buys the land from someone. The builder gets planning permission, puts a house on the site and registers the address to be connected to the water, gas and electricity supplies, as well as the phone line. Then, when it’s finished, the builder finds a buyer. The ownership is transferred in exchange for money.

Without blockchain, all of this information, from the land ownership details to the final price and utility information, would have to be recorded by separate companies – the electricity, gas and water companies, for example. It would, therefore, all be in different places, and for the buyer, getting hold of it all could be difficult and time-consuming. Plus, if there are any mistakes along the way it could cause problems later as everyone tries to work out where an error was made.

Now, let’s think about how blockchain could improve the process. At each point in the chain a new block would be created in the blockchain and added to the previous blocks. The builder could add land registry information, planning documents and utility details. They could also add useful legal information, like who is responsible for fixing a fence if it falls down. Then, when the house is finished, the buyer could get access to the blockchain and see all of the information that they need about the house in one secure place.

In this way, one single chain of data can be created and shared easily with those that need it. If the buyer decides to sell the house later they have all the information they need, and the person buying it from them knows for a fact that all of the information is correct and legal because the blockchain cannot be edited or changed. It’s secure, and it makes every step of the process quicker and easier.

This is just one small example, but when you think about what this can mean for big businesses, where ordering parts or selling electronic products are an everyday occurrence, you can see why it’s changing the way people work.

What about Bitcoin?

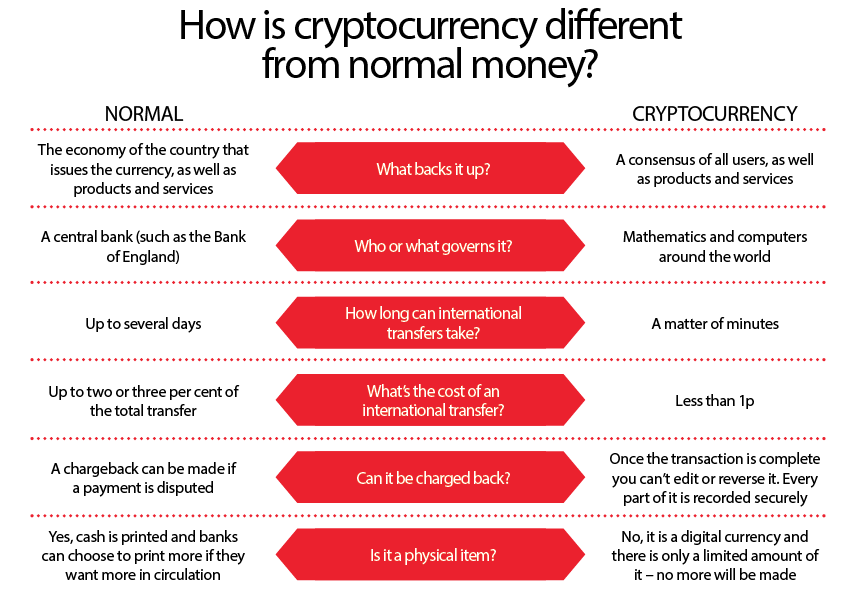

While blockchain makes transactions like the one above safer, limits on currencies like dollars and pounds can still slow down the process of buying and selling. It costs money to transfer funds and it can take time for transfers to be approved. In business, wasted time is wasted money.

Cryptocurrencies like Bitcoin aren’t like normal currencies. There’s no central bank that controls them. Instead, powerful computers can solve complex mathematical puzzles to ‘mine’ coins over time. And, unlike normal currencies (which banks can just print more of), there’s a limited number of Bitcoin that can ever be produced. Only 21 million will ever exist, and only a small number of new coins can be mined every hour. The rate at which they appear will reduce slowly until no more can be mined.

It’s all possible thanks to blockchain. The Bitcoin chain logs how much any person has and this is securely shared across the world. You can’t just change your records to say you have more Bitcoin than you do – the blockchain keeps a clear record that’s constantly updated.

In the house example above, a private blockchain would be used. Only users that have been invited to join the chain would have access to the blocks and be able to see the data. Some people in the chain, such as the estate agent, would only be granted permission to see a limited amount of information in the chain.

The Bitcoin network is open, so the integrity of transactions can be easily monitored. It also keeps transfers more private because there is no need for identity checks. When someone submits a transaction, the network protocol looks back through the previous transactions for that currency to confirm the sender has enough Bitcoin and the authority to send them. If they do, the transaction can go through.

This might sound shady, but in reality, a unique wallet helps to identify users, and law enforcement can use this ID to track users if needed. Plus, most transactions need to have an identifier logged with the transfer by law, and because this is recorded on an open network it makes Bitcoin a less-than-ideal currency for criminals.

Finally, like all transfers that are made through blockchain, it is not possible to edit or reverse a transaction once it is completed. In fact, the only way to undo a transaction is to fulfil the identical transaction in the opposite direction. In that case, both transactions would be fully tracked in the chain for everyone to see. It makes cryptocurrencies like Bitcoin an extremely secure way to trade.

There are lots of types of cryptocurrency, but Bitcoin is certainly the biggest, and while it isn’t the only use for blockchain, it’s definitely the most well known. However, blockchain technology has huge potential, and many businesses are already using it to make fast, secure transactions. Whether it will become something that normal people use every day remains to be seen, but it certainly has the potential to change the way we live.

This article was originally published in How It Works issue 117, written by Stephen Ashby

For more science and technology articles, pick up the latest copy of How It Works from all good retailers or from our website now. If you have a tablet or smartphone, you can also download the digital version onto your iOS or Android device. To make sure you never miss an issue of How It Works magazine, subscribe today!